Young Researcher Paper Award 2025

🥇Winners

🥇Winners

Print: ISSN 0914-4935

Online: ISSN 2435-0869

Sensors and Materials

is an international peer-reviewed open access journal to provide a forum for researchers working in multidisciplinary fields of sensing technology.

Online: ISSN 2435-0869

Sensors and Materials

is an international peer-reviewed open access journal to provide a forum for researchers working in multidisciplinary fields of sensing technology.

Tweets by Journal_SandM

Sensors and Materials

is covered by Science Citation Index Expanded (Clarivate Analytics), Scopus (Elsevier), and other databases.

Instructions to authors

English 日本語

Instructions for manuscript preparation

English 日本語

Template

English

Publisher

MYU K.K.

Sensors and Materials

1-23-3-303 Sendagi,

Bunkyo-ku, Tokyo 113-0022, Japan

Tel: 81-3-3827-8549

Fax: 81-3-3827-8547

MYU Research, a scientific publisher, seeks a native English-speaking proofreader with a scientific background. B.Sc. or higher degree is desirable. In-office position; work hours negotiable. Call 03-3827-8549 for further information.

MYU Research

(proofreading and recording)

MYU K.K.

(translation service)

The Art of Writing Scientific Papers

(How to write scientific papers)

(Japanese Only)

is covered by Science Citation Index Expanded (Clarivate Analytics), Scopus (Elsevier), and other databases.

Instructions to authors

English 日本語

Instructions for manuscript preparation

English 日本語

Template

English

Publisher

MYU K.K.

Sensors and Materials

1-23-3-303 Sendagi,

Bunkyo-ku, Tokyo 113-0022, Japan

Tel: 81-3-3827-8549

Fax: 81-3-3827-8547

MYU Research, a scientific publisher, seeks a native English-speaking proofreader with a scientific background. B.Sc. or higher degree is desirable. In-office position; work hours negotiable. Call 03-3827-8549 for further information.

MYU Research

(proofreading and recording)

MYU K.K.

(translation service)

The Art of Writing Scientific Papers

(How to write scientific papers)

(Japanese Only)

Sensors and Materials, Volume 33, Number 9(1) (2021)

Copyright(C) MYU K.K.

Copyright(C) MYU K.K.

|

pp. 3053-3068

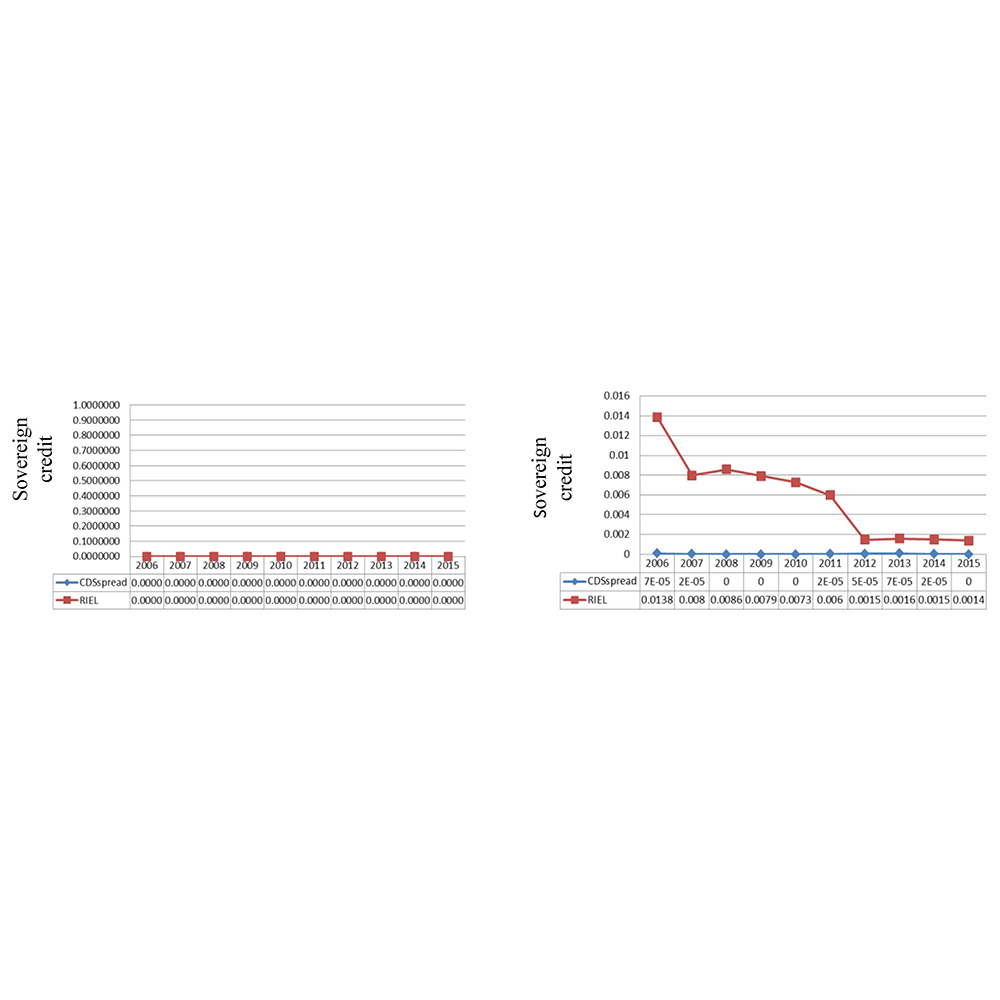

S&M2673 Research Paper of Special Issue https://doi.org/10.18494/SAM.2021.3244 Published: September 10, 2021 Prediction of Sovereign Credit Risk Rating Using Sensing Technology [PDF] Chen-Ying Yen, Yi-Ling Ju, Shih-Fu Sung, Yu-Lung Wu, and En-Der Su (Received December 31, 2020; Accepted August 24, 2021) Keywords: Internet of Things (IoT), CDS spread, sovereign credit rating

In recent years, the study and application of sensor technology have expanded from the industrial to the commercial, financial, and even medical fields. In Taiwan, many studies link sensor technology and the Internet of Things (IoT) with commercial finance, and research on their applications to commercial financial warning or company management is being conducted. The cross-discipline integration of IoT and finance has advanced through the diversification of IoT, and that is why the financial service industry will use IoT as a service platform to provide cross-disciplinary integration services. After exchanging and collecting information by using sensors and handheld devices, it helps to develop new business models such as supply chain financial services to share and manage networks. This enables the financial industry to have a more comprehensive and different understanding of customers and enterprises, which can help the financial industry explore different business opportunities. The aim of this study is to use IoT technology to perform real-time analysis of treasury bill big data and to apply the principles behind sensing to predict and analyze the probability of international defaults in order to reduce investment risks and estimate the credit default swap (CDS) spread. We will then compare the results for the macroeconomic variables with the results of relevant analyses on indicators. The results of the correlation analysis show that the CDS spread and the ratio of the current account balance (CAB) to the gross domestic product have a negative correlation with the gross domestic product growth (GDPG) rate. It has a positive correlation with the inflation rate (INF), the ratio of government debt to gross domestic product (DEBT), and the industrial production index annual growth rate (IPIG). Therefore, the result and the rating-implied expected loss (RIEL) are the same as those in the relevant analysis results of these five macroeconomic indicators. It was also found that IoT technology can be used in the real-time analysis of large-scale treasury bill data, and the principle of sensing can be applied to predict and analyze the accuracy of international defaults.

Corresponding author: Shih-Fu Sung  This work is licensed under a Creative Commons Attribution 4.0 International License. Cite this article Chen-Ying Yen, Yi-Ling Ju, Shih-Fu Sung, Yu-Lung Wu, and En-Der Su, Prediction of Sovereign Credit Risk Rating Using Sensing Technology, Sens. Mater., Vol. 33, No. 9, 2021, p. 3053-3068. |

Forthcoming Regular Issues

Forthcoming Special Issues

Special Issue on Novel Sensors, Materials, and Related Technologies on Artificial Intelligence of Things Applications

Guest editor, Teen-Hang Meen (National Formosa University), Wenbing Zhao (Cleveland State University), and Cheng-Fu Yang (National University of Kaohsiung)

Call for paper

Special Issue on Mobile Computing and Ubiquitous Networking for Smart Society

Guest editor, Akira Uchiyama (The University of Osaka) and Jaehoon Paul Jeong (Sungkyunkwan University)

Call for paper

Special Issue on Advanced Materials and Technologies for Sensor and Artificial- Intelligence-of-Things Applications (Selected Papers from ICASI 2026)

Guest editor, Sheng-Joue Young (National Yunlin University of Science and Technology)

Conference website

Call for paper

Special Issue on Innovations in Multimodal Sensing for Intelligent Devices, Systems, and Applications

Guest editor, Jiahui Yu (Research scientist, Zhejiang University), Kairu Li (Professor, Shenyang University of Technology), Yinfeng Fang (Professor, Hangzhou Dianzi University), Chin Wei Hong (Professor, Tokyo Metropolitan University), Zhiqiang Zhang (Professor, University of Leeds)

Call for paper

Special Issue on Multisource Sensors for Geographic Spatiotemporal Analysis and Social Sensing Technology Part 5

Guest editor, Prof. Bogang Yang (Beijing Institute of Surveying and Mapping) and Prof. Xiang Lei Liu (Beijing University of Civil Engineering and Architecture)

Special Issue on Advanced GeoAI for Smart Cities: Novel Data Modeling with Multi-source Sensor Data

Guest editor, Prof. Changfeng Jing (China University of Geosciences Beijing)

Call for paper

-

For more information of Special Issues (click here)

-

Special Issue on Materials, Devices, Circuits, and Analytical Methods for Various Sensors (Selected Papers from ICSEVEN 2025)

- Accepted papers (click here)

- Voltage Reflex and Equalization Charger for Series-connected Batteries

Cheng-Tao Tsai and Jia-Wei Lin

- Voltage Reflex and Equalization Charger for Series-connected Batteries

- Accepted papers (click here)

- Design and Development of a Fuzzy-logic-based Long-range Aquaculture System

Sheng-Tao Chen and Tai-I Chou

- Design and Development of a Fuzzy-logic-based Long-range Aquaculture System

Guest editor, Chien-Jung Huang (National University of Kaohsiung), Mu-Chun Wang (Minghsin University of Science and Technology), Shih-Hung Lin (Chung Shan Medical University), Ja-Hao Chen (Feng Chia University)

Conference website

Call for paper

Special Issue on Sensing and Data Analysis Technologies for Living Environment, Health Care, Production Management, and Engineering/Science Education Applications (2025)

Guest editor, Chien-Jung Huang (National University of Kaohsiung), Rey-Chue Hwang (I-Shou University), Ja-Hao Chen (Feng Chia University), Ba-Son Nguyen (Lac Hong University)

Call for paper

Special Issue on Advances in Sensors and Computational Intelligence for Industrial Applications

Guest editor, Chih-Hsien Hsia (National Ilan University)

Call for paper

Special Issue on AI-driven Sustainable Sensor Materials, Processes, and Circular Economy Applications

Guest editor, Shih-Chen Shi (National Cheng Kung University) and Tao-Hsing Chen (National Kaohsiung University of Science and Technology)

Call for paper

Special Issue on Intelligent Sensing and AI-driven Optimization for Sustainable Smart Manufacturing

Guest editor, Cheng-Chi Wang (National Sun Yat-sen University)

Call for paper

- Accepted papers (click here)

Copyright(C) MYU K.K. All Rights Reserved.